Do you know what your attitude towards money is?

ShareYour financial attitude is an aspect that determines your financial wellbeing. For the economic empowerment educational program for sex workers, we will be looking at financial attitudes first.

Why are we starting with financial attitudes?

There are three reasons why I want you to better understand your own financial attitude.

- Firstly, if you have a negative relationship with money, you’re not going to be able to engage with the economic empowerment material. You’ll just switch off at the first opportunity or at the first sign of discomfort. I want you to feel confident and to feel it is worth your while working to improve your financial attitude, despite the discomfort.

- Secondly, our financial attitude changes over time because our circumstances change over time, for better or for worse. Whatever happens, I want you to equip you with the skills to orient yourself when change inevitably arrives, so you don’t feel disenchanted in the face of strife, or complacent in the face of fortune.

- Thirdly, there is no real right or wrong when it comes to money. There’s only harder or easier. For me to help you improve your financial wellbeing as easy as possible, I need to work on your strengths, and there are strengths inherent in all financial attitudes.

Some experts have argued that your financial attitude is more of an indication of financial well-being than the actual size of your income. It makes sense then why understanding and improving our financial attitudes is the first unit for the economic empowerment program.

What are financial attitudes?

Like most things in life, the way in which we respond to money is largely dictated by our life experiences, our unique personalities, our values and belief systems. The way we think and feel about money is determined primarily by three components:

- The first is our internal factors, which are cognitive in nature. That means it comes from our thinking brain, what do we know from our personal experiences, what are our beliefs, our personality?

- Combine this with the second component that comes from our heart, which are effective in nature. This means our emotions, what do we think is right or wrong, good or bad, and all other judgements.

- The third component is the way we act, the behaviours we exercise around money, what we do when we interact with money, the actions we take.

The combination of these 3 components (cognitive, affective and behavioural) is called your financial attitude. We all have a financial attitude, whether we consciously determined this for ourselves or not.

Many of our views around money stem from the subconscious, and it's important to recognise that financial attitudes are more about how you feel towards money, and money-making decisions, than it is about specific knowledge or ability.

That means to improve your financial attitude, we don’t really have to learn anything related to finance, what we need to do is look inwards at ourselves.

We need to talk about our feelings and thoughts, and get to the fundamental beliefs and experiences that inform how we interact with money.

Has anyone ever asked you how much money you need to feel safe? Has anyone ever asked what you think we gain by spending money? Have you ever asked yourself those questions? Have you ever been curious to learn where your outlook came from and at what point your perspective, at its core, was determined?

Why would I change my financial attitude?

There are consequences to ignorance and understanding your own financial attitude is a good example. In the same way that you learned about money from other people, your financial attitude influences everyone around you, whether you’re aware of it or not.

It’s time to get curious and to learn about ourselves. Understanding your own financial attitude will help inform your decisions and strengthen your understanding of how money works for you, and what weaknesses you need to pay a little closer attention to.

Money is modern day magic, you can turn it into anything you want, and your financial attitude has a major impact on your long-term financial sustainability. Not just for yourself but for everyone around you.

Your financial attitude is about your state of mind, your personal opinions and judgements which are all informed by the three components mentioned earlier. Your attitude towards money influences your financial behaviour as your attitude tends to shape your goals, priorities and decision making processes.

The great thing about financial attitudes is that they can be consciously shaped and modified through experience, education and most importantly self-reflection.

How do I improve my financial attitude?

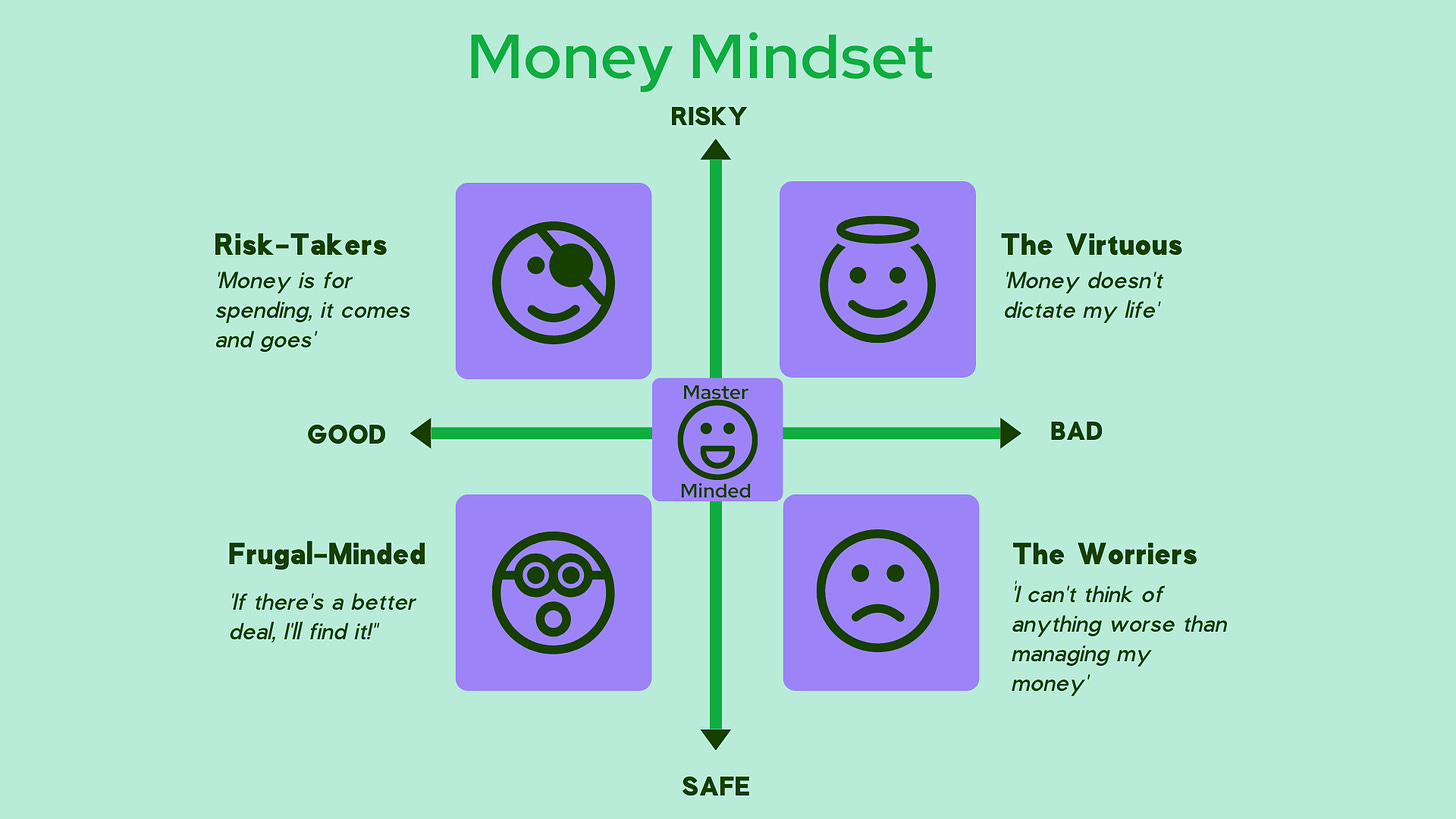

To improve, we must first understand ourselves and where we are. If we imagine financial attitudes as existing on two axes, on one our inherent judgment about money good versus bad, on the other, our inherent approach to money risky versus safe, then we have four quadrants in which to understand financial attitudes. This simplified rendition of financial attitudes is just one framework to figure out where you sit and where you need to go.

You could be ‘The Worrier, ‘Frugal-Minded, ‘The Risk-Taker’, ‘The Virtuous’ or ‘Master-Minded’. Everyone lands somewhere in these quadrants, and despite the names of the axes, no attitude is entirely good/bad, safe or risky, because there are inherent skills in each approach or attitude towards money.

What is truly dangerous, or harder to live with, is having a fixed financial attitude towards personal finance, because the reality is, everything changes whether we like it or not. The economy, the world, our bodies, our health. We create and we lose, change is the only constant in life and if your attitude does not adjust with the times, things will become harder.

The aim of the game is to become ‘Master-Minded’, because the ‘Master’ can slide up and down these axes and adapt to the situation they’re in. There will be times in life where it is more effective to be safer or riskier. There will be times where you can feel good about money or times where you can stop and think about whether you’re using your money in an ethical manner. That’s why the aim is to orient yourself to be a ‘Master’, as this financial attitude is the most flexible.

These labels can help us determine how we approach money, and what we need to work on as individuals to increase the potential for financial wellbeing and success. Each of these quadrants have a set of skills and strengths that you can draw upon.

We have created six sex worker characters that embody each of the financial attitudes: ‘Messy Jessie, ‘Prue the Shrewd’, ‘Risky Misty’, ‘Good-Girl Pearl’, ‘Chaotic Katie’ and ‘Queen Bae’. Each of these character will have their own character profile (to be posted in this Substack very soon) to detail their strengths, psychology and weaknesses.

To figure out which of the six you are most like, we are also creating a personality test to determine your financial attitude. This blog post will be updated when we make this test available. If you would like to be notified it’s best to subscribe to our Substack.

These characters are simplified renditions of our complex realities. They’re not perfect characters or to be taken too literally. They are used here to help us build the cognitive infrastructure and awareness about what financial attitudes are, how they appear in our lives and how they change over time.

Until the test and characters go live, be curious with yourself about your thoughts and feelings towards money. This is your prompt to simply witness (do not judge) the feelings and thoughts that pass by you every time you interact with money.

No comments yet. Be the first to leave one.